Cash Equivalents Will Be Converted to Cash Within

A balance sheet item which equals the sum of all money owed by a company and due within one year. Your third step is to determine the total assets your company owns.

Note 1 Cash And Cash Equivalents Annual Reporting

For example on its balance sheet a company has in millions cash and cash equivalents of 45000 short-term marketable securities of 50000 accounts receivable of 20000 and total liabilities of 100000.

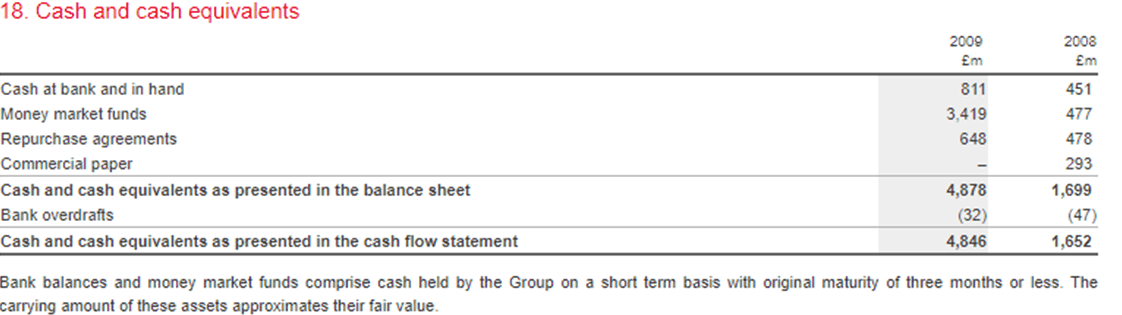

. Cash flow refers to the inflow and outflow of cash and cash equivalents. Cash equivalents include money market securities bankers acceptances are readily convertible and subject to insignificant risk. Cash-flow is generated by business operations investments and financing.

Examples include savings accounts T-bills Treasury Bills T. Cash equivalents are typically investments that have short-term maturities of less than 90 days and are considered liquid assets because they can be readily converted to cash. Find the beginning balance of each account that you can categorize as cash or cash equivalents such as your cash account.

A balance sheet item which equals the sum of cash and cash equivalents accounts receivable inventory marketable securities prepaid expenses and other assets that could be converted to cash in less than one year. Based on the analysis future cash flows are. These bonus cash rewards will show as redeemable within 1 2 billing periods after they are earned.

It determines a businesss cash position and cash availability. ATM transactions cash advances of any kind balance transfers SUPERCHECKS cash equivalents such as money orders and prepaid gift cards. A measure of the average.

Current assets on the balance sheet include cash cash equivalents short-term investments and other assets that can be quickly converted to cashwithin 12 months or less. Find the Total Assets Category. This companys liquidity ratio 45000 50000 20000100000 115.

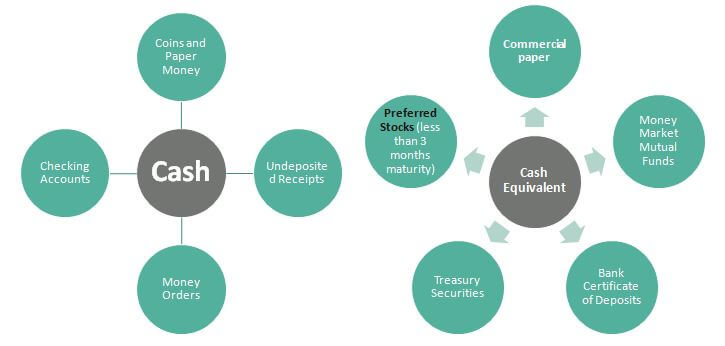

Cash equivalents Cash Equivalents Cash and cash equivalents are the most liquid of all assets on the balance sheet. Cash set aside for a specific purpose is called restricted cash and is not part of your cash and cash equivalents balance. Examples of which consist of Cash and Paper Money US Treasury bills undeposited receipts Money Market funds etc.

Analyzing a companys cash-flow provides critical information about its financial health business activities and reported earnings. Cash equivalents consist of very safe liquid investments that you expect will be converted into cash within 90 days. Determine the value of the cash only.

Cash advances and balance transfers do not apply for purposes of this offer and may affect the credit line available for this offer. Cash and Cash Equivalents usually found as a line item on the top of the balance sheet asset is those set of assets that are short-term and highly liquid investments that can be readily convertible into cash and are subject to low risk of change in price. Because these assets are easily turned into cash they.

This liquidity ratio is greater than 1 so many companies would. Cash equivalents are assets that can be converted into cash quickly. The latter refers to securities that can be converted into cash within three months or less including CDs treasury bills and commercial paper among other things.

Cash Equivalents. Current assets are a balance sheet item that represents the value of all assets that could reasonably be expected to be converted into. You will find the value toward the bottom of the balance sheet on.

Cash Equivalents Definition Examples Complete Guide

Cash Equivalents Definition Examples Complete Guide

Cash And Cash Equivalents Example Of Cash And Cash Equivalents

No comments for "Cash Equivalents Will Be Converted to Cash Within"

Post a Comment